Gross annual income calculator hourly

This net income calculator provides an overview of an annual weekly or hourly wage based on annual gross income of 2022. Wisconsin Hourly Paycheck Calculator.

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Payroll Checks

Calculate your Annual take home pay based of your Annual salary to see full calculations for Pay As You Earn PAYE National Insurance Contributions NICs Employer National Insurance Contributions ENICs Pension Dividend tax etc.

. The gross profit margin calculator exactly as you see it above is 100 free for you to use. Total gross annual income If Sarah is eligible for deductions of 5000 for education andor childcare expenses. Thats where the free Wage Conversion Calculator comes into play.

This calculator is based on 2022 British Columbia taxes. This Texas hourly paycheck calculator is perfect for those who are paid on an hourly basis. Fill the weeks and hours sections as desired to get your personnal net income.

The Wisconsin personal income tax rates range from 4 to 765. Cost of goods sold. The calculator on this page is provided through the ADP Employer Resource Center and is designed to.

Biweekly Salary Annual Salary 26. Net salary calculator from annual gross income in British Columbia 2022. Weekly Salary Daily Salary Days per workweek.

This hourly rate to annual salary calculator can help them to figure out how much they really earn in a year. In Louisiana the top rate of 6 kicks in at income over 50000 for single filers and income over 100000 for joint filers. Actors with membership in the Chorus Equity Association in New York City - minimum pay shown in Union Scales of Wages and Hours1930.

Hourly Daily Weekly Monthly Income Conversion. Gross Annual Income of hours worked per week x of weeks worked per year x hourly wage Example. The first four fields serve as a gross annual income calculator.

You can easily convert your hourly daily weekly or monthly income to an annual figure by using some simple formulas shown below. Semi-Monthly Salary Annual Salary 24. While the annual salary represents a floor for an employees wages gross pay can exceed that level.

Others may put employees on an annual salary paying them in monthly or quarterly installments. Do Wisconsin have personal income tax. Annual income is the amount of income you earn in one fiscal year.

Quarterly Salary Annual Salary 4. Gross income per month Hourly pay x Hours per week x 52 12. They can do so by multiplying their hourly wage rate by the number of hours worked in a week.

Click the Customize button above to learn more. Multiply this amount by the number of paychecks you receive each year to calculate your total annual salary. Calculate your annual salary.

Then multiply that number by the total number of weeks in a year 52. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Use our Monthly Gross Income Calculator to calculate your monthly gross income based on how frequently you are paid and your gross income per pay period.

Sara works an average of 37 hours per week and takes two weeks off per year. This British Columbia net income calculator provides an overview of an annual weekly or hourly wage based on annual gross income of 2022. Important Note on the Hourly Paycheck Calculator.

This calculator is based on 2022 Ontario taxes. To determine a businesss annual gross income here is an example. Gross income per month Annual salary 12.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Yes Arkansas residents pay personal income tax. He inputs his numbers and solves.

Example of Annual Income Calculator. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Find your total gross earnings before deductions on your pay stub.

Lets calculate an example together. Compare that to New Jersey where the top rate doesnt kick in until your income hits 1 million. Total annual gross income.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. For instance if an employee is paid an annual salary of 23000 per year but is eligible for and works 5000 worth of overtime that workers gross pay will be 28000 -- more than the salary figure. Gross income is money before taxationYou can read more about it in the gross to net calculator.

Wages for farm workers are compared to that of factory workers. Fill the weeks and hours sections as desired to get your personnal net income. Taxes are a complex subject and how they are.

Your annual income includes everything from your yearly salary to bonuses commissions overtime and tips earned. The salary numbers on this page assume a gross or before tax salary. Overview of New York Taxes New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status.

In case you want to convert hourly to annual income on your own you can use the math that makes the calculator work. Gross income is the income you receive before any outside expenses are deducted. The formula of calculating annual salary and hourly wage is as follow.

You may hear it referred to in two different ways. Does Arkansas collect personal income tax. As you examine your paycheck pay stub or job offer letter you may see a gross income listed.

To calculate gross annual income enter the gross hourly wage in the first field of this yearly salary calculator. Total annual gross business income. If you are contemplating a new job comparing your present wage structure with a prospective new employers is vital to making an informed financial decision.

Monthly Salary Annual Salary 12. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. Your gross income will be a larger number than your net income.

Agricultural wages Farm workers wages and income - 1909 to 1938 Farm wage rates are broken out by year and geographic location. The 2022 Annual Tax Calculator calculates your take home pay based on your Annual Salary. Gross annual income and net annual incomeGross annual income is your earnings before tax while net annual income is the.

The result in the fourth field will be your gross annual income. How Your Paycheck Works. Yes Wisconsin has a progressive personal income tax system with 4 income brackets.

You earn per pay period and the calculator shows you your monthly gross income. Knowing your annual net income can help you best understand what additional expenses you can handle. Annual Salary Hourly Wage Hours per workweek 52 weeks.

To calculate your net salary you will need to subtract federal and local income taxes as well as other deductions. Calculate your annual salary with the equation 1900 x 26 49400. Pay Frequency Use 2020 W4.

There are six personal income tax brackets that range from 09 to 7. Use the Arkansas hourly paycheck calculator to see the impact of state personal income taxes on your paycheck. Suppose you are paid biweekly and your total gross salary is 1900.

For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52000. Net salary calculator from annual gross income in Ontario 2022. To determine gross monthly income from hourly wages individuals need to know their yearly pay.

If you are paid hourly multiply your hourly wage by the number of hours you work per week. And unlike some of the other income tax states Louisianas top tax bracket starts at a relatively low income.

Calculating Income Hourly Wage Youtube

Salary To Hourly Paycheck Calculator Omni Salary Budget Saving Paycheck

Hourly To Salary Calculator

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Worksheet Template

Annual Income Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com

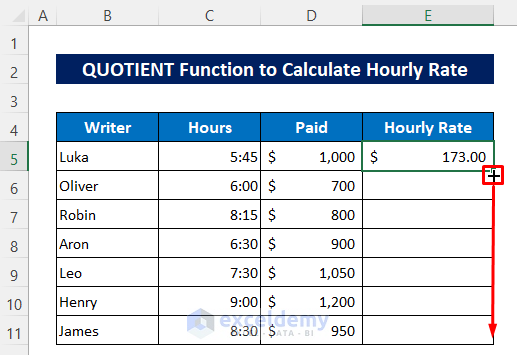

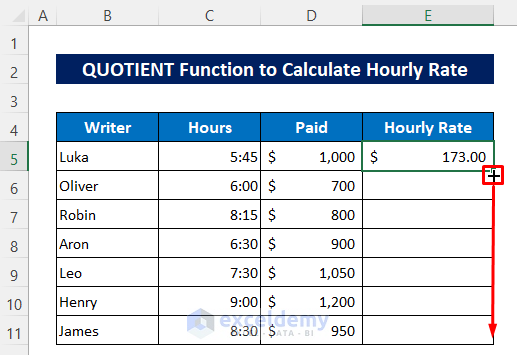

How To Calculate Hourly Rate In Excel 2 Quick Methods Exceldemy

Hourly To Annual Salary Calculator How Much Do I Make A Year

Payslip Templates 28 Free Printable Excel Word Formats Templates Excel Templates Business Template

3 Ways To Calculate Your Hourly Rate Wikihow

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Payroll Taxes

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Templates Excel Templates

Gst Calculator How To Find Out Goods And Service Tax Tax Refund

Salary To Hourly Calculator

Hourly To Salary Calculator

Pricing With Confidence Wedding Planner Pricing And Services Wedding Planning Worksheet Wedding Planning Business Wedding Planner

Hourly To Salary What Is My Annual Income